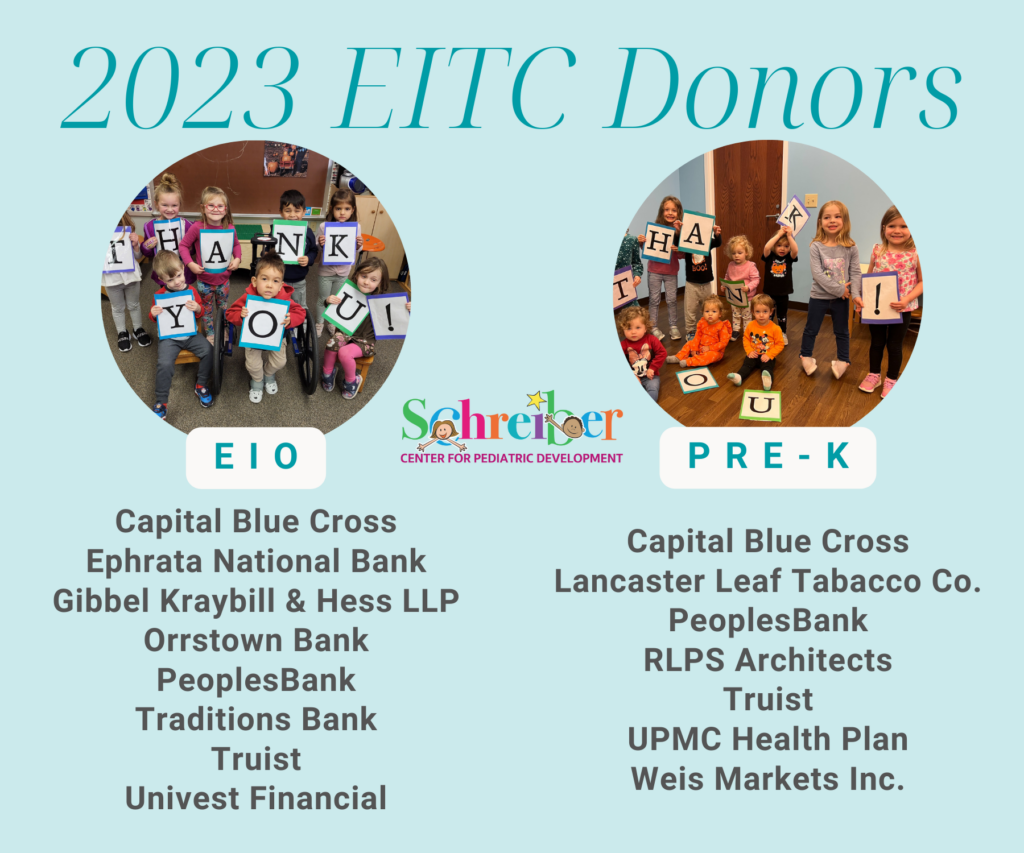

EITC Program

Support Schreiber through EITC

Businesses have another way to make a financial contribution to Schreiber: Pennsylvania’s Educational Improvement Tax Credit Program. For the first time, money that would otherwise be used to pay your Pennsylvania tax liability can now be directed to support Schreiber’s S.T.A.R.S. Preschool and Circle of Friends Academy child care, as well as our various recreation programs, including our summer camps.

The state offers a step-by-step guide for registering to make EITC donations. Read or download the guide here. Go directly to the portal for donating here.

You can donate to Schreiber in either or both of two categories:

EDUCATIONAL IMPROVEMENT ORGANIZATION

Schreiber is an approved Educational Improvement Organization (EIO). We partner with Lancaster County-based high schools to provide supplemental learning opportunities in childcare (CC), human services (HS) and disability inclusion (DI). These scholastic enhancement programs provide innovative activities of learning which benefit children served at Schreiber. They also provide service-learning opportunities for high school students that allow them to fulfill graduation requirements. Throughout the year, students may volunteer with our Circle of Friends Academy, S.T.A.R.S. Preschool, Respite, Club 625 and Camp Schreiber. View our EIO flyer to learn more about these opportunities or contact Jenn Vasko at 717-393-0425 ext. 106 or via email at jvasko@schreiberpediatric.org.

PREKINDERGARTEN SCHOLARSHIP ORGANIZATION

Schreiber is an approved Prekindergarten Scholarship Organization. Contributions in this category help to subsidize tuition payments for low-income qualifying families who attend our S.T.A.R.S. Preschool or Circle of Friends Academy childcare. Since the 1970s, Schreiber has been proud to offer inclusive learning opportunities bringing together typically developing children with peers who have a special need. As a benefit to parents, pre-k students who require therapy services may receive those services while attending preschool or childcare.

Why support Schreiber?

“Since our founding in 1876, Univest Bank and Trust Co. has focused on making a difference in the communities we serve. Youth and Education is our primary area of focus for our giving and utilizing the Pennsylvania’s EITC program helps us increase our support to local nonprofits dedicated to enhancing educational opportunities for children. At Univest, we seek partners like Schreiber Pediatric who make it their mission to help children grow and flourish to their full potential. Univest takes its role as a corporate citizen seriously. We are proud of the impact we make as a result of our unwavering community-based principles and the passion of our employees who live out our community core value every day.”

Tom Jordan

President, Lancaster Division

Univest Bank and Trust Co.

“As a small business owner, the EITC provides an opportunity to direct PA tax dollars to organizations and causes that are important to us. We are able to witness firsthand the impact these dollars have on our community. These tax dollars have to be paid each year, so why not direct them to organizations we wish to support? Who wouldn’t want to do this!”

Rich Riva

President and Owner

Wire-Mesh Products Inc.